Compare Health Insurance Quotes in Minutes: Your Ultimate UK Guide

In today’s fast-paced world, finding the right health insurance plan in the UK can feel overwhelming. With a myriad of providers, policy types, and price points, how do you ensure you’re getting the best cover for your needs—without overpaying? That’s where a dedicated UK comparison website specialising in health insurance comes in. By aggregating quotes from multiple insurers in one place, you can make an informed choice quickly and confidently.

Why Use a Specialist Comparison Site?

Time Savings

Gathering quotes directly from individual insurers can take hours—filling out forms, waiting for call-backs, and deciphering policy jargon. A comparison site streamlines this process by presenting tailored quotes side by side in just a few clicks.

Comprehensive Market Coverage

Specialist comparison platforms partner with a broad range of UK insurers, from household names like Bupa and AXA to niche providers offering tailored plans. This ensures you’re seeing the full spectrum of options.

Transparent Pricing

With instant, like-for-like comparisons, you can easily spot which policies offer the most value. Look beyond premiums to check excess levels, benefit limits, and any hidden fees—all clearly laid out.

How It Works

Enter Your Details

Start by providing basic information: age, postcode, existing medical conditions, and cover requirements (e.g., outpatient, dental, or mental health support).

Receive Tailored Quotes

The platform’s algorithm matches your profile against participating insurers, returning personalised quotes in seconds.

Compare Side by Side

Use intuitive filters—by price, excess, insurer rating, or specific benefits—to narrow down your choices. Many sites also highlight “Best Value” or “Most Popular” options.

Apply Directly Online

Once you’ve chosen a policy, you can often complete the application and payment online, finalising your cover without leaving the site.

Key Features to Consider

- Excess Levels: A higher excess usually lowers your premium but increases your out-of-pocket cost when you claim.

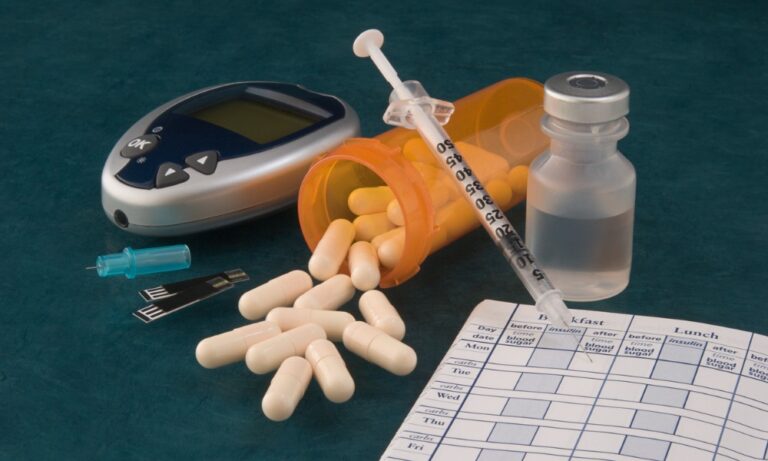

- Benefit Limits: Check annual and per-claim caps, especially for high-cost treatments like oncology or cardiac care.

- Waiting Periods: Some policies impose waiting periods for pre-existing conditions or certain treatments—make sure these align with your expectations.

- Additional Perks: Look for wellness benefits, gym discounts, or access to virtual GP services, which can enhance value without adding much to the premium.

Top Tips for Finding the Best Quote

Be Honest About Health Conditions

Accurate disclosure ensures your cover is valid. Undisclosed conditions could lead to claim refusals.

Consider Your Lifestyle

If you travel frequently, look for policies with comprehensive international cover. If you have a family, multi-person discounts can lead to significant savings.

Review Renewal Terms

Some insurers offer low introductory premiums that rise steeply on renewal. Check renewal rates or choose a plan with fixed-premium guarantees.

Use Critical Illness Add-Ons Wisely

While premiums increase, critical illness cover can provide a lump sum at diagnosis—worth considering if you have a family dependent on your income.

FAQs

Can I switch providers mid-term?

Yes, but always compare potential savings against any cancellation fees you might incur.

Are online quotes binding?

Quotes are provisional until underwriting is complete. Final premiums may adjust based on full medical declarations.

Do comparison sites charge a fee?

No—comparison websites are typically free for users; they earn commission from insurers when you purchase through their platform.

Securing the right health insurance needn’t be a daunting task. A dedicated UK comparison website specialising in health insurance quotes empowers you to explore the market, understand policy nuances, and make a confident decision—all in a matter of minutes. Whether you’re a single professional, a growing family, or a retiree seeking peace of mind, start your quote comparison today to ensure you and your loved ones have the cover you deserve.